It’s hard to argue that the banner ad era has been good to publishers. After a brief initial period in which banner inventory matched audience availability, publishers enjoyed double-digit CPMs and advertisers enjoyed unique access to a valuable audience of online “early adopters.” Prognosticators heralded a new golden era of publishing, and predicted the eventual death of print. Fifteen years later, print is barely breathing, but publishers are still awaiting a “golden era” where the promise of online media matches its potential. What happened on the long road of publisher monetization, and how did we arrive in this new “programmatic” era?

It didn’t take long after HotWired sold the first banner ad to AT&T for other online properties to start making banner ads part of every page they put onto the Web. Not immune to Adam Smith’s economic theory, banner CPMs lowered as impression availability rose. Suddenly, publishers were in the single digits for their “ROS” inventory, and had plenty of impressions left over every month. Smart technology companies like Tacoda saw an opportunity to aggregate this unsold inventory, and sell it based on behavioral and contextual signals they could collect. Thus, the Network Era was born. Because networks understood publishers’ audiences better than the publishers did, they were able to sell ads at a $5 CPM and keep $4 of it. That was a great business for a very long time, but is now coming to an end.

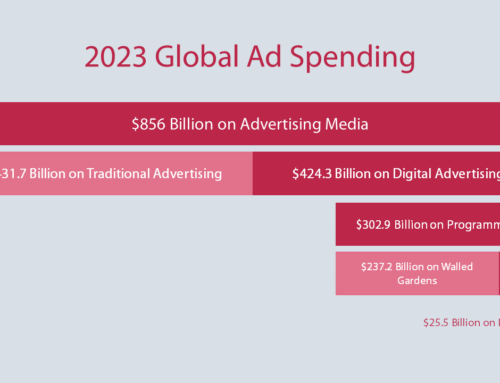

While not creating tremendous value for publishers, the Network Era did manage to pave the way for real time bidding, and the start of the Programmatic Era. Hundreds of millions of cookies, combined with a wealth of third-party data on individuals, presented a truly unique opportunity to separate audiences from the sites the visited, and enable marketers to buy one impression at a time. This was great for companies like Right Media, who aggregated these cookies into giant exchanges. For advertisers, being able to find the “auto intender” in the 5 trillion-impression haystack of the Web meant new performance and efficiency. For publishers, this was another way to further segregate audience from the valuable content they created. The DSP Era ensured that only the inventory that was hardest to monetize found its way into popular exchanges. Publishers ran up to a dozen tags at a time, and let SSPs decide which bids to accept. Average CPMs plunged.

Over the last several years, it seems like publishers — at least those with enough truly premium inventory — are fighting back. Sellers have brought programmatic efficiencies in two ways: implementing DMP technology to manage their real programmatic (RTB) channel; and leveraging programmatic direct (sometimes call “programmatic premium”) technologies to bring efficiencies to the way they hand-sell their guaranteed inventory. Let’s look at both:

- Programmatic/RTB: Leveraging today’s DMP technology means not having to rely on third-parties to identify and segment audiences. Publishers have been trying to take more control of their audiences from day one. The smartest networks (Turn, Lotame) saw this happening years ago and opened up their capabilities to publishers, giving them the power and control to sell their own audiences. With the ability to segment and expand audiences, along with new analytics capabilities, publishers were able to capture back the lion’s share of revenue, previously lost to Kawaja-map companies via disintermediation.

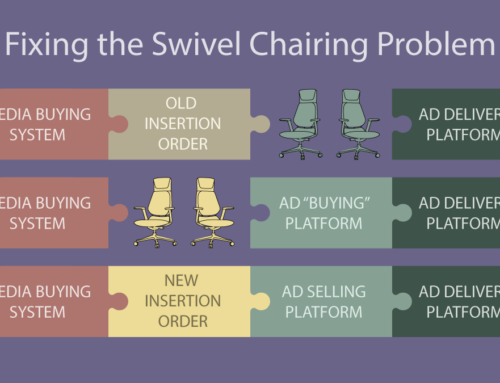

- Programmatic Direct: Although 80% of the conversation in publisher monetization has revolved around the type of data-driven audience buying furnished by LUMAscape companies, 80% of the display advertising spending has been happening in a very non-real-time way. Despite building enough tech to RTB-enable the globe, most publishers are selling their premium inventory one RFP at a time, and doing it with Microsoft Excel spreadsheets, PowerPoints, PDFs, and even fax machines. RTB companies are trying to pivot their technology to help publishers bring efficiency to selling premium inventory through private exchanges. Other supply-side companies (like iSocket, ShinyAds, and AdSlot) are giving publishers the tools to sell their premium ads (at premium prices) without bidding—and without an insertion order. On the demand side, companies like Centro, Facilitate, MediaOcean, and Bionic (disclosure: I work there) are trying to build systems that make planning and buying more systematic, and less manual.

As programmatic technology gains broader acceptance among publishers, they will find that they have turned the monetization wheel 180 degrees back in their favor. DMP technology will enable them to segment their audiences for targeting and lookalike modeling on their own sites, as well as manage audience extension programs for their clients via exchanges. They will, in effect, crate a balanced RTB playing field where DSPs and agency trading desks have a lot less pricing control. Programmatic Direct (or, more correctly, “systematic reserved”) technologies will help them expose their premium inventory to selected demand side customers at pre-negotiated prices, and execute deals at scale.

The Programmatic Era for publishers is about bringing power and control back into the hands of inventory owners, where it has always belonged. This will be good for publishers, who will do less to devalue their inventory, as well as advertisers, who will be able to access both channels of publisher inventory with greater efficiency and pricing transparency.

This article originally appeared on in AdExchanger.